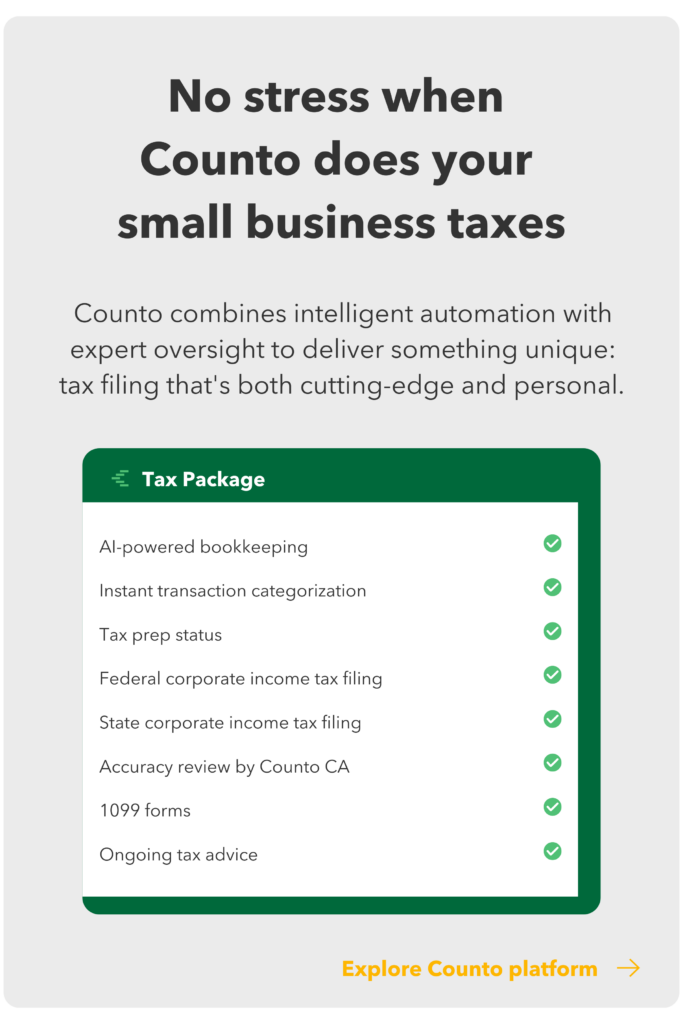

Corporate Tax Filing for US Businesses, Done Right

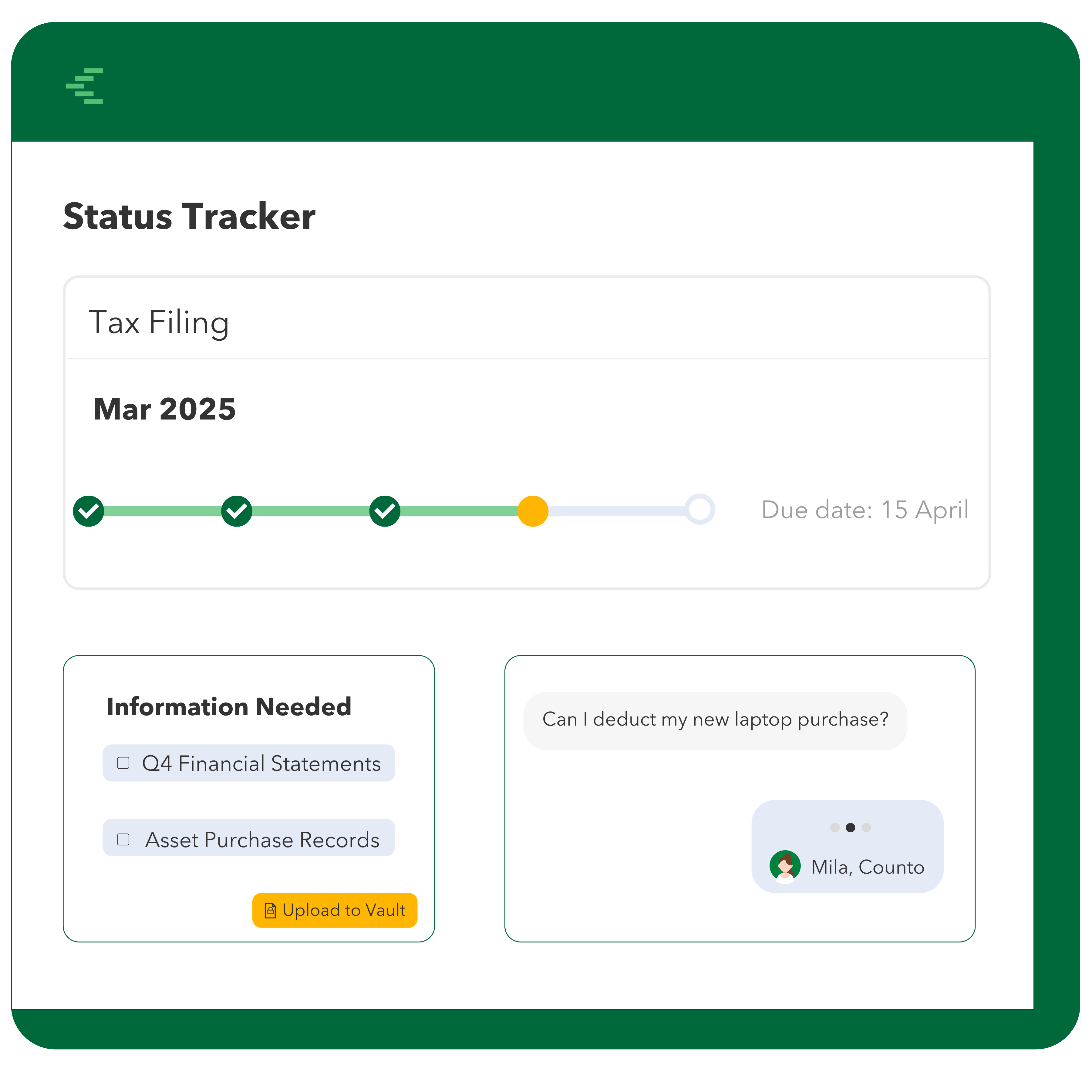

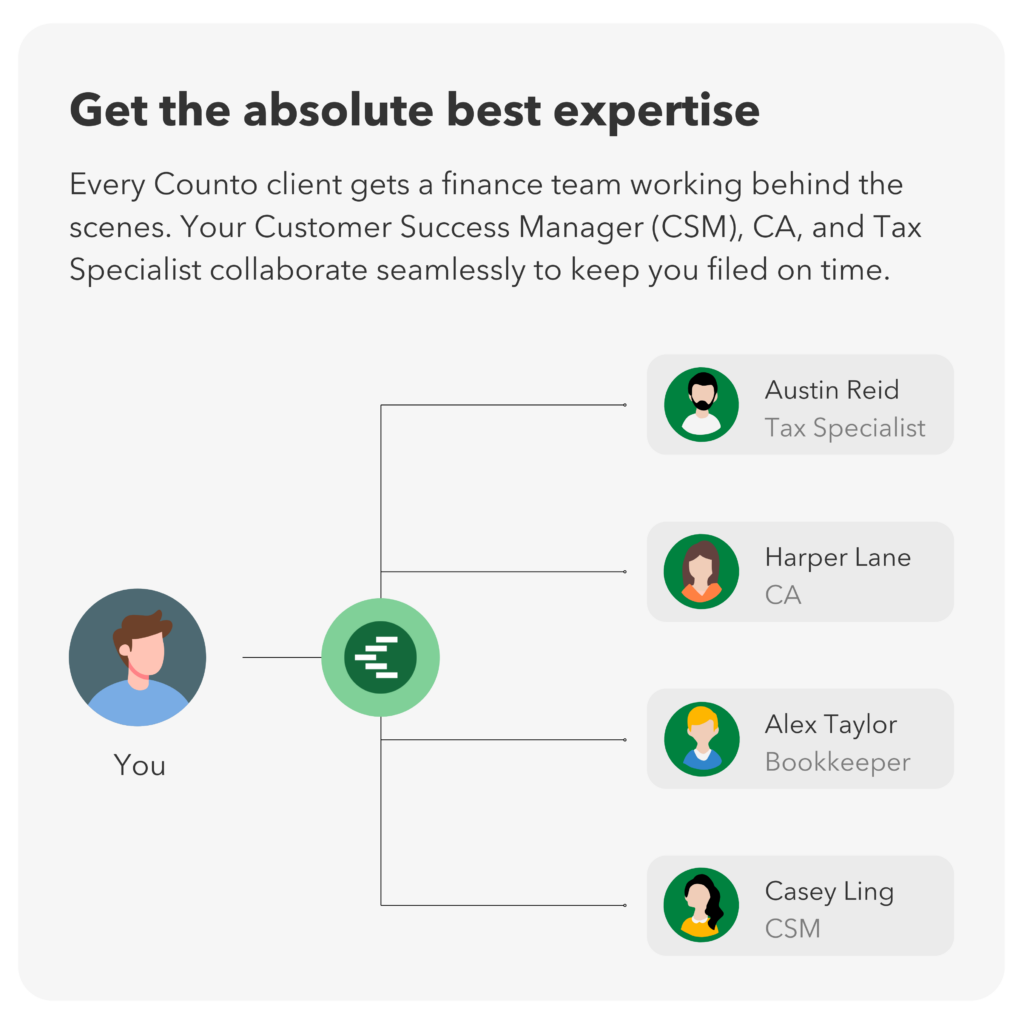

Leave the business tax complexity to us. Our experts handle your federal and state tax returns with precision, powered by intelligent automation that catches every detail.

Behind on your books? Our Annual Reporting Plan (view plan →) or Books+Taxes package (scroll down ↓) gets you caught up and compliant fast. Choose the option that works best for you.

Let’s talk about your needs. Chat with us now or drop us a message here.