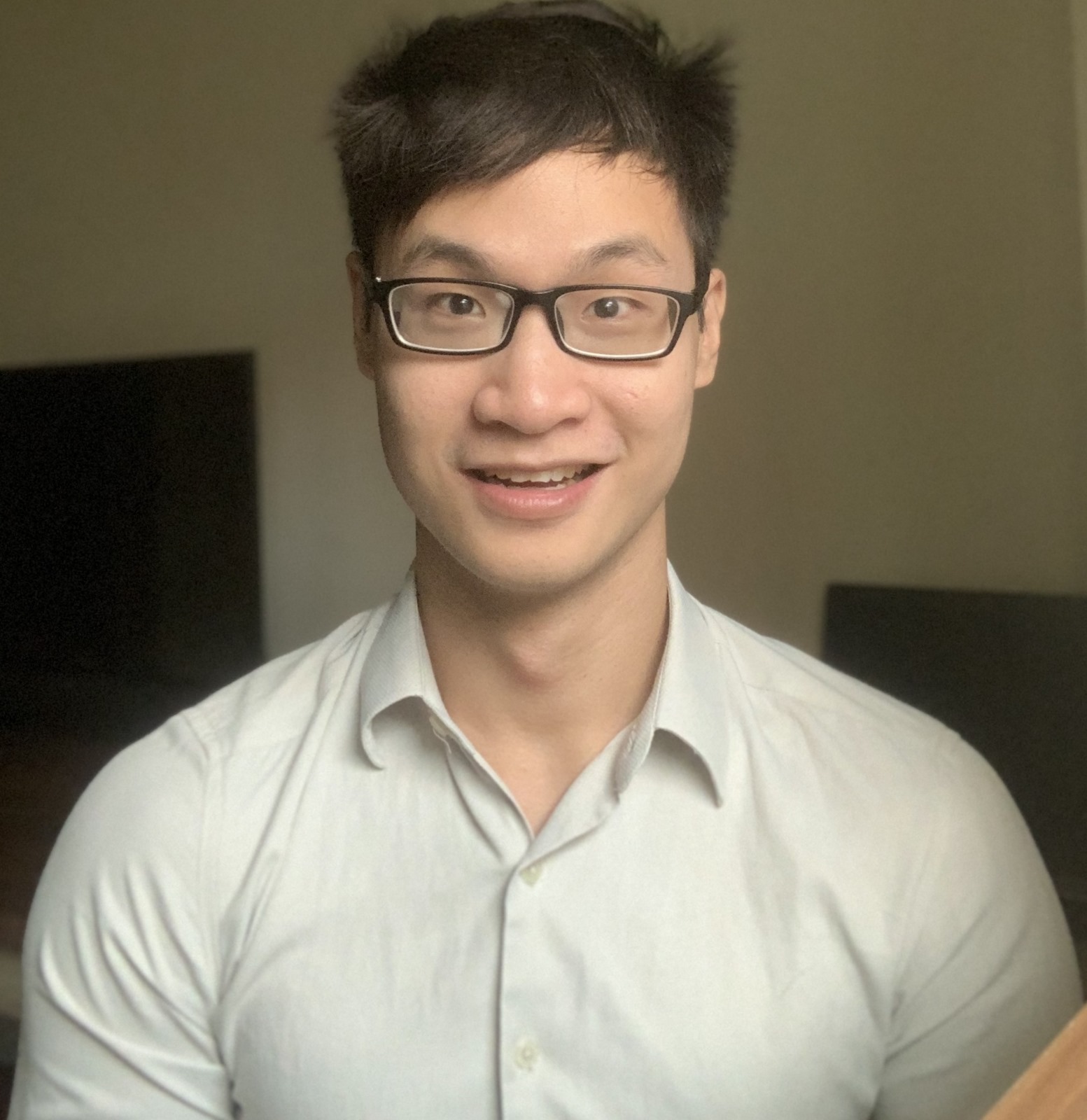

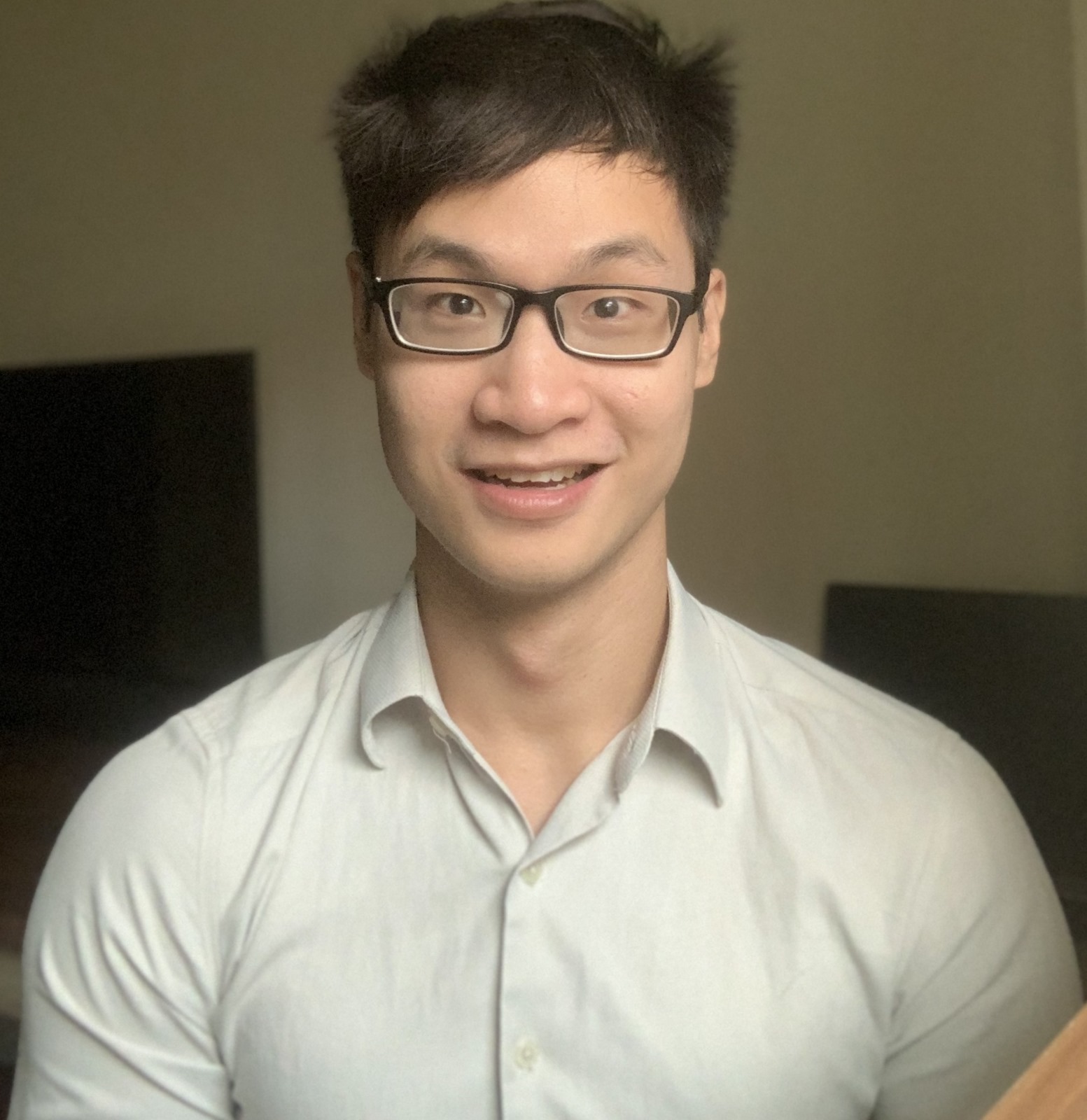

Lachlan E-commerce Retailer

“If you’re in the E-commerce field involving large numbers of transactions, Counto is the ultimate solution to save you time on your accounting. Their customer service also always goes above & beyond.”

Bookkeeping, tax filing, payroll, and compliance—Counto gives Delaware-based LLCs and corporations everything they need to stay compliant and financially healthy.

Backed by a powerful AI platform and a dedicated team of real accountants, we handle the back office so you can focus on growing your business.

Whether you’re incorporated in Delaware for its founder-friendly laws or physically operating in the state, Counto helps you compliant—without juggling multiple providers.

We take care of your monthly bookkeeping, payroll processing, and all required tax filings. That includes your Delaware Franchise Tax, State Corporate Income Tax, and Federal Corporate Income Tax—filed accurately and on time, every year.

Here’s what Counto gives you — your own Customer Success Manager, Chartered Accountant, Bookkeeper, and Tax Specialist. We’re always ready to help, so you’re never left waiting, guessing, or managing your back office alone.

Clean, up-to-date financials powered by our AI-driven platform—perfect for tax season or investor updates.

Run payroll and issue 1099s with ease. We support multi-state filings and automatic calculations.

We help prepare and file your Delaware Franchise Tax and Annual Report—on time, every time.

We combine smart automation with real experts to deliver accurate books, fast payroll, and worry-free compliance—at a fraction of the cost of old-school accounting firms or cobbled-together apps.

| Counto | Traditional Firm | DIY Software | |

|---|---|---|---|

| Reliable expert bookkeeping | ✔ | ⚠️ | ⚠️ |

| Dedicated accountant | ✔ | ⚠️ | ✖ |

| End-to-end payroll | ✔ | ⚠️ | ⚠️ |

| Delaware Franchise Tax filing | ✔ | ⚠️ | ✖ |

| Flat pricing | ✔ | ✖ | ✔ |

| Custom chart of accounts | ✔ | ⚠️ | ⚠️ |

Curious about cost? See our transparent pricing plans — flat monthly rates, no hourly surprises →

“A very competent team… the (Counto) system provides a convenient way to upload and view documents. My queries are always promptly answered… and the staff are pleasant to work with.”

“Very very happy with the speed and quality of (Counto’s) service, on top of the very fair price and super high friendliness. I used a different partner before and am extremely happy I made the switch.”

“If you’re in the E-commerce field involving large numbers of transactions, Counto is the ultimate solution to save you time on your accounting. Their customer service also always goes above & beyond.”

“If you’re in the E-commerce field involving large numbers of transactions, Counto is the ultimate solution to save you time on your accounting. Their customer service also always goes above & beyond.”

“Very very happy with the speed and quality of (Counto’s) service, on top of the very fair price and super high friendliness. I used a different partner before and am extremely happy I made the switch.”

“A very competent team… the (Counto) system provides a convenient way to upload and view documents. My queries are always promptly answered… and the staff are pleasant to work with.”

Delaware offers valuable tax credits to encourage innovation and local job creation. Counto helps eligible businesses unlock and apply for key incentives, including:

We handle the calculations, paperwork, and filings—so you can focus on building your business while we help you get money back.

At Counto, we’re not just here to help you unlock tax credits — we’re also serious about keeping things simple and predictable when it comes to cost.

No hourly rates. No billable emails. Just one clear monthly price based on your annual revenue — designed to scale with your business.

Whether you’re launching your first LLC or scaling a venture-backed startup, Counto gives you more than just clean books — you get a full back office and a dedicated team that gets things done, on time and without the runaround.

One platform. One team. Everything done for you.

Counto is an all-in-one accounting service that combines smart automation with a dedicated finance team. We handle your bookkeeping, payroll, taxes, payments, and compliance—so you don’t have to juggle multiple vendors, apps, or disconnected platforms. Everything you need is managed in one place, by one trusted team.

We combine two things most accounting firms can’t match: cutting-edge AI technology and truly personal support. While our intelligent automation handles everything from transaction processing to complex analysis, you get something equally valuable—direct access to your dedicated Customer Success Manager (CSM) via phone or SMS.

This dual approach sets us apart. Our AI technology drives efficiency and reduces costs, while your dedicated team ensures you get expert guidance whenever you need it. It’s the best of both worlds: advanced automation that saves you money, plus the kind of personal support typically reserved for large enterprise clients.

Yes. All Delaware LLCs are required to pay an annual Franchise Tax of $300—even if your LLC had no revenue or activity. Unlike corporations, LLCs do not need to file an Annual Report, but the tax must be paid by June 1st to avoid penalties.

Yes. Like LLCs, all Delaware-formed Limited Partnerships and General Partnerships are required to pay a flat $300 Franchise Tax each year. The deadline for payment is June 1st, and failing to pay on time can result in penalties and interest charges.

For C-Corps, the Delaware Franchise Tax and Annual Report are due by March 1st each year. For LLCs, the flat $300 Franchise Tax is due by June 1st. Counto keeps track of these deadlines for you and ensures your filings are submitted on time.

Delaware C-Corporations can calculate their Franchise Tax using one of two methods: the Authorized Shares Method or the Assumed Par Value Capital Method. You’re allowed to use whichever results in the lower tax bill.

Authorized Shares Method: If your corporation has 5,000 shares or fewer, your minimum tax is $175. Between 5,001 and 10,000 shares, the tax increases to $250. Beyond that, you’ll pay $250 plus $85 for every additional 10,000 shares (or portion thereof), up to a maximum of $200,000 per year.

Assumed Par Value Method: This method is based on your issued shares and total gross assets, using figures from your IRS Form 1120 (Schedule L). The calculation involves dividing total assets by the number of issued shares to get a per-share value, which Delaware uses to calculate your assumed capital. The tax is $400 per $1 million (or part thereof), with a minimum of $400 and a maximum of $200,000 annually. If your company has $2.3 million in gross assets and 500,000 issued shares, your tax would be: $400 × 3 (since $2.3M rounds up to 3 million) = $1,200.

Need help calculating the lowest-cost method for your Delaware C-Corp? Counto takes care of the math and the filing—so you never have to worry about penalties or overpaying. Contact us here.

Yes. In addition to the Franchise Tax, Delaware corporations must also pay a $50 state filing fee when submitting their Annual Report.

If your corporation is exempt from Franchise Tax (such as certain non-profits), the filing fee is reduced to $25. These fees are charged by the Delaware Division of Corporations and are due at the time of filing.

Absolutely. Whether you’re using QuickBooks, Xero, or another accounting software, we’ll sync or migrate your data for free. Our team will handle the transition and make sure you don’t lose any history or momentum.

When you sign up for our accounting service, you’ll gain access to a dedicated team comprising a bookkeeper, Chartered Accountant, tax specialist, and a Customer Success Manager (CSM).

Your CSM serves as your primary point of contact, available via SMS, phone, or email—to readily address any queries or concerns.

For our CFO customers, we elevate your experience with an exclusive dedicated channel through Slack. This platform fosters real-time interaction between your team and ours, guaranteeing swift responses to your financial questions and promoting seamless collaboration.