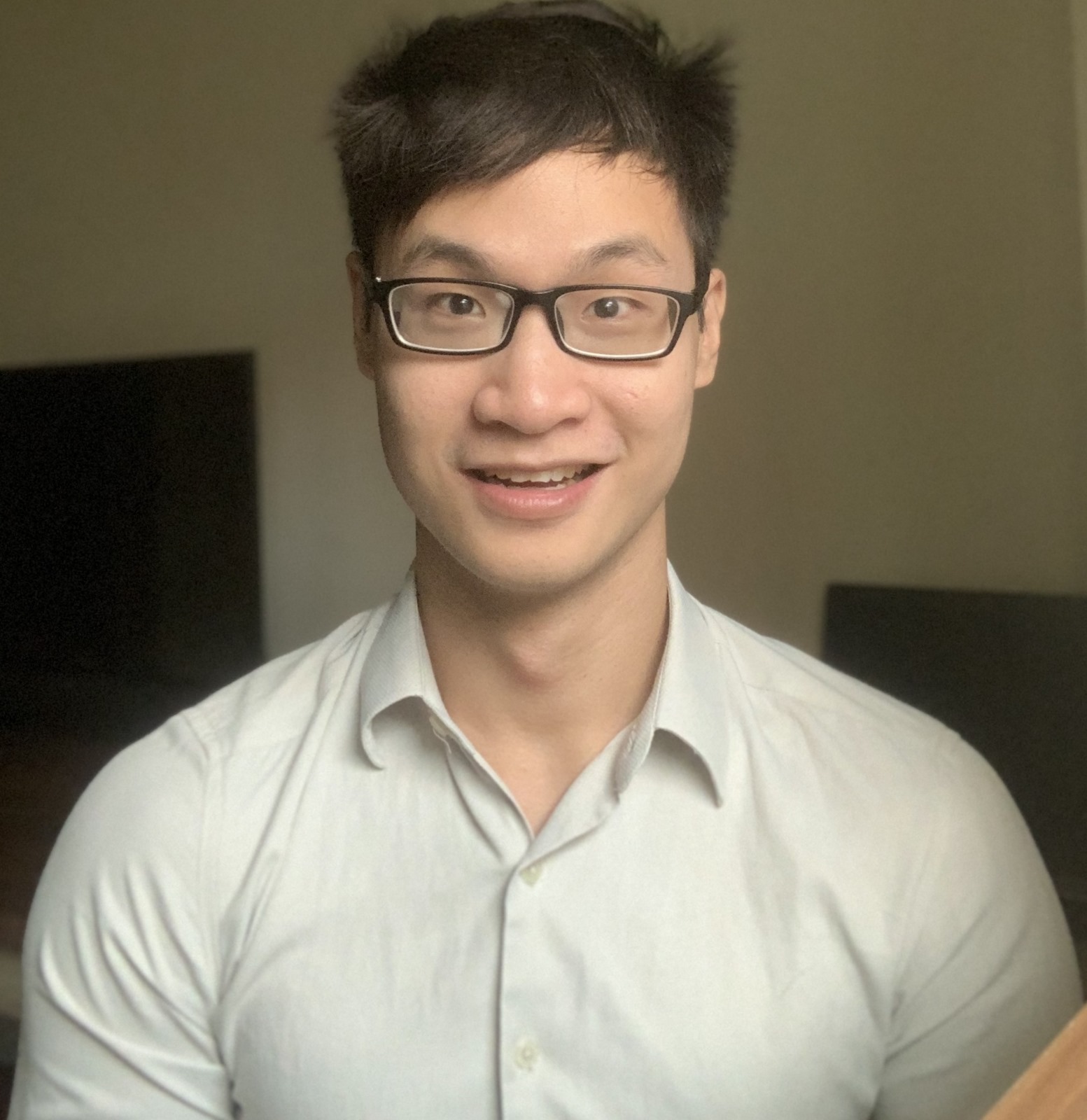

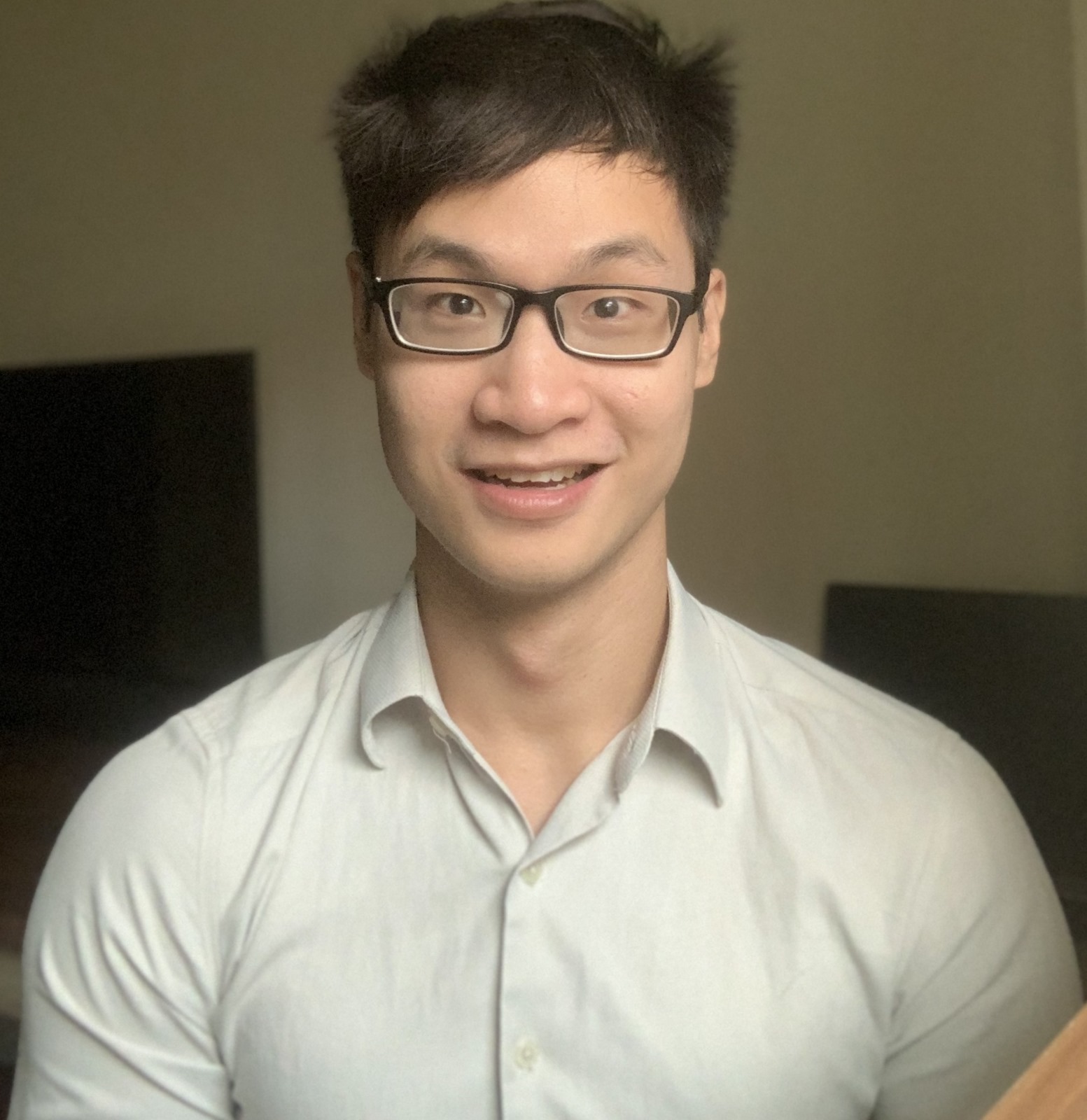

Lachlan E-commerce Retailer

“If you’re in the E-commerce field involving large numbers of transactions, Counto is the ultimate solution to save you time on your accounting. Their customer service also always goes above & beyond.”

Bookkeeping, tax filing, payroll, and compliance—Counto gives New York–based LLCs, C-Corps, and startups everything they need to stay financially sharp, without juggling outdated spreadsheets or clunky software.

Powered by an intelligent AI platform and a dedicated team of real accountants, we handle the back office so you can stay focused on growing your business.

We automate the busywork and deliver clean books—faster than your current accountant. Enjoy seamless workflows and real-time visibility across one connected platform.

You get a dedicated Customer Success Manager, Chartered Accountant, Bookkeeper, and Tax Specialist—all working together to manage your finances, so you’re never left waiting, guessing, or handling your back office alone.

Unlike other firms that charge extra for tax prep, your Counto accounting plan includes corporate tax filings—no surprise fees, no scrambling at year-end. You stay compliant with:

Clean, up-to-date financials powered by our AI-driven platform—perfect for tax season or investor updates.

Run payroll and issue 1099s with ease. We support multi-state filings and automatic calculations.

Automate vendor payments and expense tracking in one place—smart insights help you cut costs and stay on top of cash flow.

We combine smart automation with real experts to deliver accurate books, fast payroll, and worry-free compliance—at a fraction of the cost of old-school accounting firms or cobbled-together apps.

| Counto | Traditional Firm | DIY Software | |

|---|---|---|---|

| Reliable expert bookkeeping | ✔️ | ⚠️ | ⚠️ |

| Dedicated accountant | ✔️ | ⚠️ | ✖️ |

| End-to-end payroll | ✔️ | ⚠️ | ⚠️ |

| NYC & State Corporate Tax Filing | ✔️ | ⚠️ | ✖️ |

| Flat pricing | ✔️ | ✖️ | ✔️ |

| Custom chart of accounts | ✔️ | ⚠️ | ⚠️ |

Legend:

✔️ = Included ⚠️ = Limited or Optional ✖️ = Not Included

Curious about cost? See our transparent pricing plans — flat monthly rates, no hourly surprises →

“A very competent team… the (Counto) system provides a convenient way to upload and view documents. My queries are always promptly answered… and the staff are pleasant to work with.”

“Very very happy with the speed and quality of (Counto’s) service, on top of the very fair price and super high friendliness. I used a different partner before and am extremely happy I made the switch.”

“If you’re in the E-commerce field involving large numbers of transactions, Counto is the ultimate solution to save you time on your accounting. Their customer service also always goes above & beyond.”

“If you’re in the E-commerce field involving large numbers of transactions, Counto is the ultimate solution to save you time on your accounting. Their customer service also always goes above & beyond.”

“Very very happy with the speed and quality of (Counto’s) service, on top of the very fair price and super high friendliness. I used a different partner before and am extremely happy I made the switch.”

“A very competent team… the (Counto) system provides a convenient way to upload and view documents. My queries are always promptly answered… and the staff are pleasant to work with.”

New York State and Federal tax credit programs reward businesses for hiring, innovating, and growing locally—but most small businesses don’t claim them. With Counto, we find the credits you qualify for, handle the paperwork, and file on your behalf.

You just get the cash.

At Counto, we’re not just here to help you unlock tax credits — we’re also serious about keeping things simple and predictable when it comes to cost.

No hourly rates. No billable emails. Just one clear monthly price based on your annual revenue — designed to scale with your business.

Whether you’re launching your first LLC or scaling a venture-backed startup, Counto gives you more than just clean books — you get a full back office and a dedicated team that gets things done, on time and without the runaround.

One platform. One team. Everything done for you.

Counto is an all-in-one accounting service that combines smart automation with a dedicated finance team. We handle your bookkeeping, payroll, taxes, payments, and compliance—so you don’t have to juggle multiple vendors, apps, or disconnected platforms. Everything you need is managed in one place, by one trusted team.

We combine two things most accounting firms can’t match: cutting-edge AI technology and truly personal support. While our intelligent automation handles everything from transaction processing to complex analysis, you get something equally valuable—direct access to your dedicated Customer Success Manager (CSM) via phone or SMS.

This dual approach sets us apart. Our AI technology drives efficiency and reduces costs, while your dedicated team ensures you get expert guidance whenever you need it. It’s the best of both worlds: advanced automation that saves you money, plus the kind of personal support typically reserved for large enterprise clients.

New York State imposes a graduated corporate income tax. Rates for C-Corps currently range from 6.5% to 7.25% depending on income brackets . New York City adds an additional corporate tax layer in some cases.

Corporate income taxes include:

New York State Corporate Franchise Tax (CT‑3)

Applies to corporations doing business in New York State.

NYC General Corporation Tax

For corporations operating within New York City.

In addition, sales taxes are: 4.0% state sales tax, Plus local sales taxes averaging around 4.53% more—bringing New York City’s combined rate to 8.875%

Yes—regardless of the structure, LLCs pay state-level taxes. Single‑member LLCs default to sole‑proprietorship filing, while multi‑member LLCs are taxed as partnerships. Both must pay New York’s gross receipts tax and, if applicable, collect and remit sales tax.

New York State sales tax is 4%, but combined with local rates it can reach up to 8.875% in NYC. Businesses selling taxable goods/services must register for a Sales Tax Certificate and file returns accordingly,

Yes—New York S‑Corps are pass-through entities. Owners report income/salary on personal returns and can deduct up to 20% Qualified Business Income (QBI), but must adhere to rules like limiting to 100 shareholders and offering a “reasonable salary.

Yes—tax preparers filing 100+ returns must use NYC’s Business Tax e-File system. Tax extensions are submitable online but only extend filing, not payment deadlines.

Absolutely. Whether you’re using QuickBooks, Xero, or another accounting software, we’ll sync or migrate your data for free. Our team will handle the transition and make sure you don’t lose any history or momentum.

When you sign up for our accounting service, you’ll gain access to a dedicated team comprising a bookkeeper, Chartered Accountant, tax specialist, and a Customer Success Manager (CSM).

Your CSM serves as your primary point of contact, available via SMS, phone, or email—to readily address any queries or concerns.

For our CFO customers, we elevate your experience with an exclusive dedicated channel through Slack. This platform fosters real-time interaction between your team and ours, guaranteeing swift responses to your financial questions and promoting seamless collaboration.